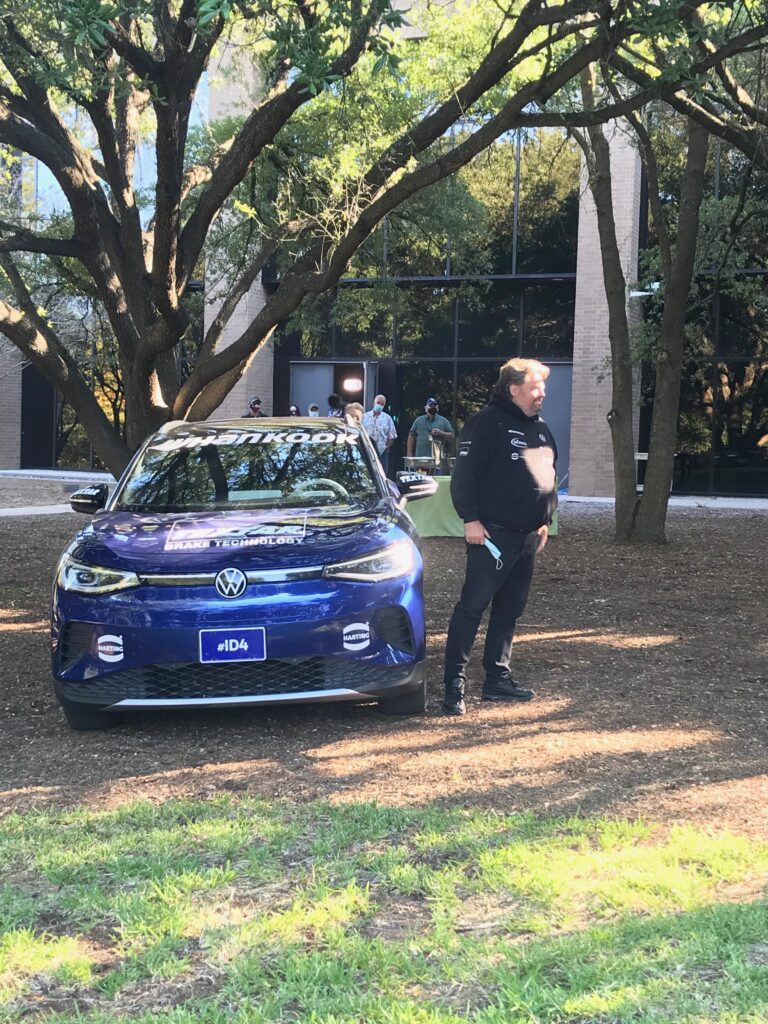

A blue Volkswagen ID.4 rolled into Austin on Friday on a quest to break a Guinness World Record for longest road trip in an electric vehicle.

“This world record should demonstrate that an EV engine car can perform the same as a combustion engine car,” said Rainer Zietlow, a professional driver who holds several electric vehicle world records.

On Friday morning, Zietlow drove the 2021 Volkswagen ID.4 onto the lawn of Infineon semiconductor’s plant in Austin. It was the fourth stop on a 37,000-mile road trip through 48 states that began on July 18th in Herndon, Virginia, and ends on Oct. 18th. The stops took place at Infineon’s locations throughout the U.S. including Austin, Livonia, Michigan, San Jose, and El Segundo, California. The last stop is in Washington, D.C.

Zietlow and his co-pilot Derek Collins of Kansas City, Mo., stopped at the Infineon fab in Austin because it has played a key role in the operations of the Volkswagen ID-4.

The Austin-based manufacturing plant, the largest for Infineon in North America, is making dozens of chips that perform various functions in the car including adaptive cruise control, emergency braking system, Wi-Fi, and Bluetooth communications. Infineon even makes the chips that power the drivetrain.

Zietlow said he can’t see or feel the Infineon chips, but that’s the point. They are the magic under the hood.

“I have a good feeling that Infineon is on board,” Zietlow said. He already holds the world record for with the Volkswagen ID-3, a smaller version of the car, with Infineon on board in Germany driving 18,000 miles and visiting 850 Volkswagen dealers.

“Our semiconductors are at the heart of vehicle electrification and the enabling charging infrastructure,” Lars Ullrich, vice president of automotive at Infineon Technologies Americas said in a news release. “By increasing range, efficiency and accessibility, we are helping the automotive industry to successfully achieve the fundamental transformation towards electromobility – to protect the environment without compromising drivers’ flexibility and comfort.”

The ID.4 is Volkswagen’s first all-electric SUV and the brand’s first global EV. With a price tag of $39,995, the vehicle can travel up to 250 miles on a fully charged battery. Zietlow uses a mobile phone app to check for his next charging station on the road. It takes about 35 minutes to recharge the battery to 85 percent, Zietlow said. Volkswagen partnered with Electrify America, which has 600 charging stations in the United States with plans to add 300 more within two years, he said. Most of the charging stations were based at Walmart stores near the highway, he said.

Infineon already has plans to expand the fab in Austin through the CHIPS for America Act, which is a bill pending in Congress that was introduced by Texas Senator John Cornyn and others, said Carl Bonfiglio, with Infineon’s automotive group based in Michigan. The Volkswagen ID.4 has more than 50 chips just from Infineon. The CHIPS for America Act would invest tens of billions of dollars in semiconductor manufacturing incentives and research initiatives over the next decade to strengthen and sustain American leadership in chip technology.

San Jose-based Infineon Technologies entered the Austin market when it bought Cypress Semiconductor, with the sale closing in April of 2020. The Austin campus was previously an AMD site. The factory, built in 1995, produces chips using 200 mm or 8-inch diameter wafers. The Austin Infineon site has 1,000 employees and 1.5 million square feet of space of which 115,000 is cleanroom space, said Steve James, vice president of Infineon’s Wafer Fab Operations. The plan is to add 40,000 square feet of cleanroom space, he said.

Roughly 70 percent of the world’s cars contain chips made in Austin, James said. More than 35 electric and plug-in hybrid models with a drivetrain using power semiconductors from Infineon will be in production worldwide this year. Infineon has been in the automotive business for more than 35 years. Electric cars have a lot more semiconductors than traditional cars, Bonfiglio said. That is also putting additional strain on the semiconductor industry as more electric vehicles hit the road.

Infineon also specializes in security. The chip that is in all U.S. passports is an Infineon chip.

As cars connect to the Internet, there is a need to ensure communications are secure and that no hacker can get into the car. That’s top of mind at Infineon.

“Technology you can trust is what Infineon seeks to provide,” Bonfiglio said.